Portrait of the Market

In analyzing markets, there's almost never a perfectly analogous historical corollary. There's always enough difference for a well-known investor, analyst, or economist to claim that "this time is different." In our experience, this prognosticator is usually wrong. We find value in reviewing history as we agree with Mark Twain, who said, "history does not repeat itself, but it often rhymes."

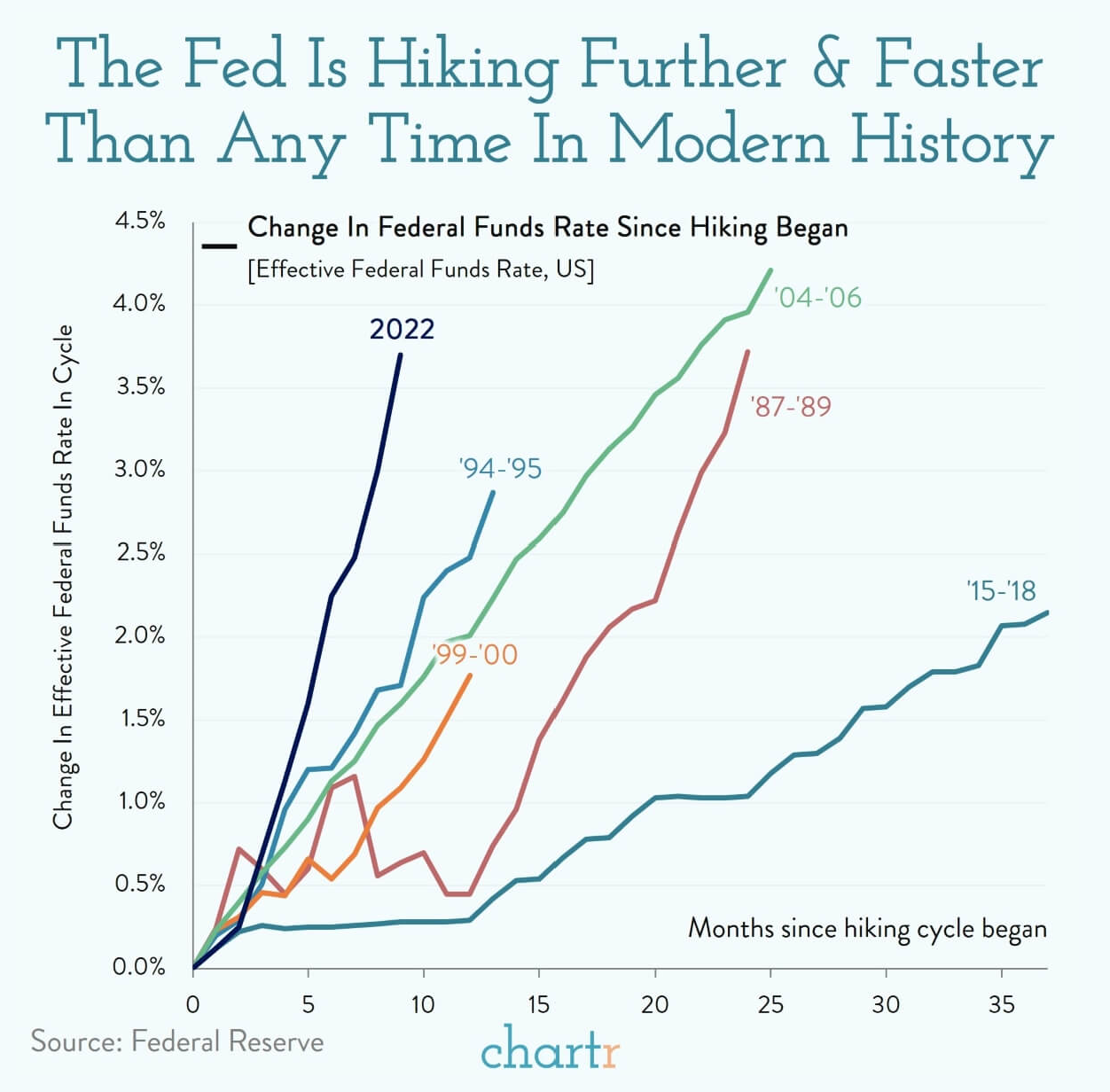

On the other hand, market historians tend to obscure major lessons as soon as the focal point becomes the average rather than the set of prior outcomes. In the chart for today, we want to highlight the recent set of Federal Reserve interest rate hiking cycles. As you can see, the speed and size of recent rate hikes far exceeds prior cycles going back to 1987.

From this, we believe there are two lessons. First, the Fed is more concerned with not doing enough to combat inflation, rather than doing too little. Second, given that the current rate cycle is the outlier of the 40-year average, investors are more likely to be surprised because they are not accustomed to this type of Fed action.

All in all, we believe the market is primed for more variability. Any unexpected move up or down in inflation or the rate hike path will likely lead to outsized moves, but little change in the range-bound trajectory we believe has taken hold. Until the Fed feels comfortable that the inflation fight has been won, we would caution all investors to hold tight and focus on the saving and spending decisions we can control.

This material is provided for informational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change at any time without notice. The information and opinions contained in this material are derived from proprietary and nonproprietary sources we deemed to be reliable and are not necessarily all-inclusive. All investing involves risk, including the possible loss of principal.