Matt’s Chart of the Week

Dividend Stocks Are Harder to Find

Going back to basics for a moment, the total return (i.e. performance) on a stock investment will always be based on two factors: (1) price movement up or down, and (2) income (i.e. dividends). For a number of reasons, including rising interest rates, recessionary concerns, and inflation risk, many advisors, including us, have told investors to invest in dividend-paying stocks as a way to hide out while the stock market goes through its latest swoon. While it’s easy to say, “invest more of your portfolio in dividend-paying stocks,” it belies a larger issue that companies have largely shifted away from dividends over the past 60 years.

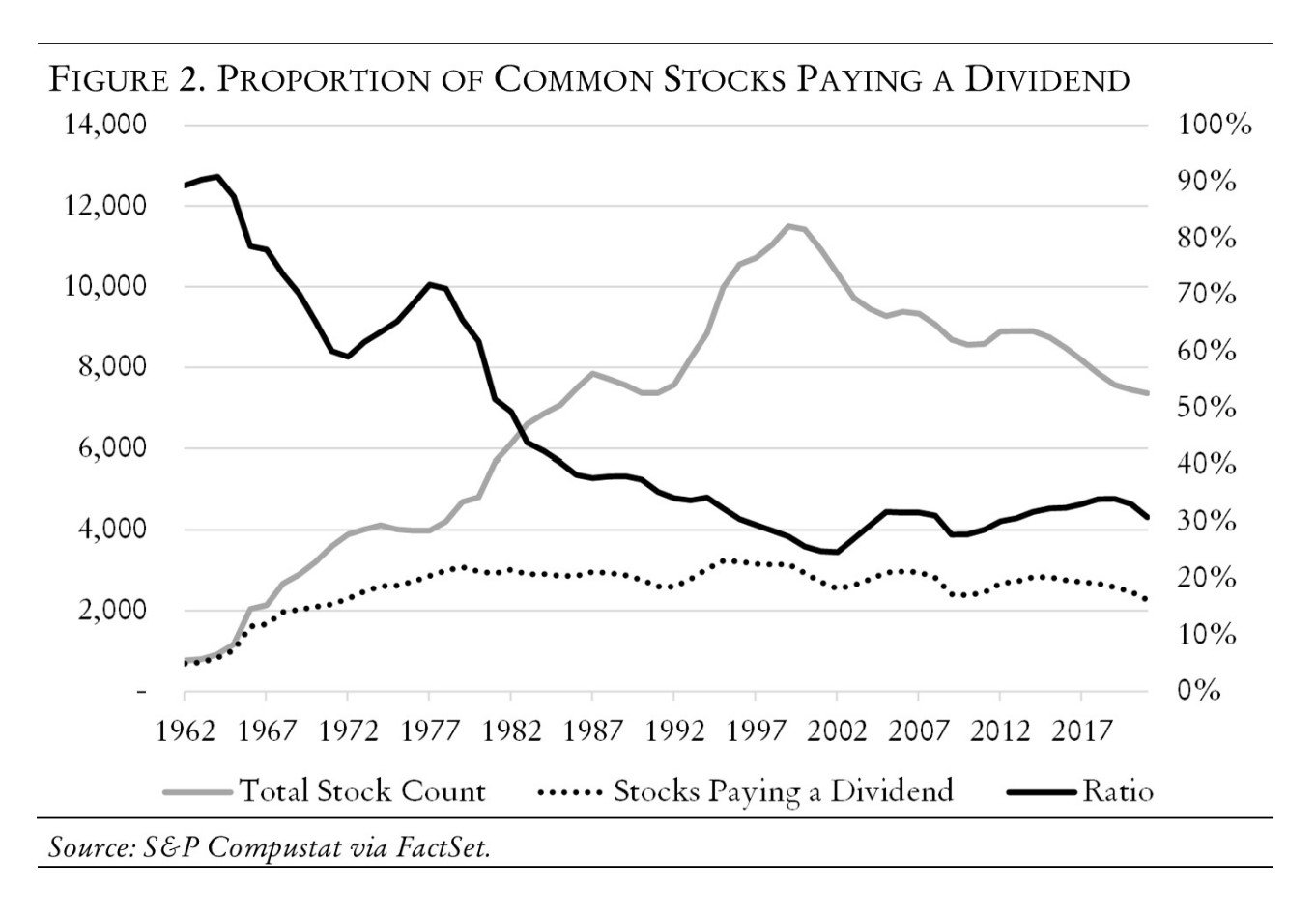

The chart below is a clear indication of how much harder it has become to find dividend-paying stocks in the U.S. stock market. While the number of public companies has grown significantly in the last half century, we see that 60 years ago, 9 out of 10 companies paid a dividend compared to only 3 of 10 public companies today.

So, why are fewer U.S. public companies paying dividends? First, as the technology curve has sped up and consumer markets have become global, we believe each company has a lower likelihood of maintaining its market share over the long-term. Therefore, in order to keep an edge on competitors, each company is more likely to reinvest its profits, rather than pay them out to shareholders in the form of dividends. A second reason is due to companies’ expanded opportunity to do stock buybacks. Until the early 1980s, although buybacks were legally permitted, companies were often reticent to do them because of the risk of being sued for stock price manipulation. However, in 1982, the SEC adopted Rule 10b-18 which provided a clear pathway for companies to repurchase shares without facing liability. Since then, we’ve seen massive increases in company buybacks and significant decreases in dividends. This broadly makes sense. Companies don’t like to make cuts to their dividends as it generally indicates the business is not doing as well and, thus, leads to downward pressure on stock price. Buybacks, on the other hand, offer companies one-off opportunities to share profits with shareholders without pressure to maintain a level of profit sharing (as is inherent with dividends).

Given these changes, we think that selecting the right dividend-paying stocks has become significantly more difficult and requires more skill. Those companies that do pay dividends are not as likely to raise them, and the ones with higher dividends may feel locked into them and are therefore not investing enough in the future of their business. While dividends may be a good place to hide out in today’s market, we caution each investor to beware of companies whose dividends are unsustainable over the long-term.

The Retreat of Dividends and the Changing Nature of the Stock Market - American Affairs Journal

This material is provided for informational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change at any time without notice. The information and opinions contained in this material are derived from proprietary and nonproprietary sources we deemed to be reliable and are not necessarily all-inclusive. All investing involves risk, including the possible loss of principal.