Portrait of the Market

In the current economic realm, there is an ongoing debate between those who view the inflation we've seen over the past few years as temporary due to pandemic-induced elements (I've seen these folks called "Team Transitory") and those who view it as more extended due to economic trends that are likely to continue (dubbed "Team Structural").

Team Transitory views the efforts by the Fed to rein in inflation as an overreach - inflation will come down on its own, they posit, and, therefore, the Fed is creating harm to Main Street by slowing the economy and increasing the risk of massive layoffs and recession. Team Transitory lost the first round of the fight when the Fed itself changed course; after consistent communication through 2021 that inflation would naturally come down, the Fed made a quick U-turn for 2022 and raised rates at the fastest pace in decades. (See our 1/3/2023 post). Team Transitory has mostly resorted to the position that cooling inflation will just take longer than initially imagined, and they counsel patience by the Fed and others.

Team Structural, on the other hand, is riding high with a chip on its shoulder from the first round. They believe that a variety of elements such as changing trade patterns away from China, the transition to renewable energy, climate change's impact on food production and heightened geopolitical risk mean that higher than 2% target inflation will be with us for many more years. This means that after an expected pause on rate hikes this year, the Fed will have to keep hiking in the future; thus, interest rate rises will continue to pressure bonds and stocks alike as they did in 2022.

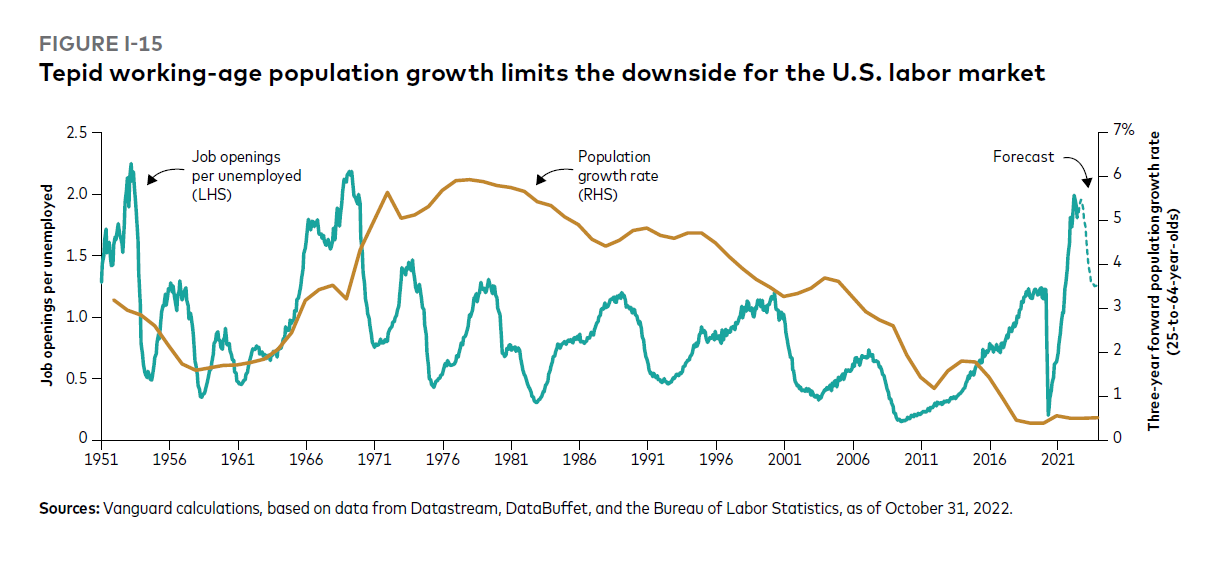

Our chart today supports Team Structural’s argument with evidence from the labor market. The blue line with the left-hand side axis tracks the number of job openings per unemployed. Here, we continue to see that the labor market remains incredibly strong with employers continuing to struggle to fill posts. The gold line with the right-hand axis tracks the U.S. population growth rate. Here, we see that, as we might expect, US population growth has been slowing since the mid-1970s.

In sum, these numbers support the idea that the wage growth we’re seeing now may be part of a continuing trend. For the past 40 years, there have been fewer people entering the work force each year; however, the baby boomer generation formed the core of the workforce and was able to fill the jobs available. With baby boomers now reaching retirement age, we expect it’ll be necessary for employers to increase wages above the recent historical trend in order to attract employees. As a result, despite Federal rate hikes, wage growth may become more embedded and lead to higher-than-expected inflation. The wage growth trend is worth following very closely even if inflation continues to cool from last year’s levels.

This material is provided for informational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change at any time without notice. The information and opinions contained in this material are derived from proprietary and nonproprietary sources we deemed to be reliable and are not necessarily all-inclusive. All investing involves risk, including the possible loss of principal.