Portrait of the Market

For years, clients would ask what to do with cash that would be needed within the next year (or maybe two) for planned spending (e.g. college tuition, down payment for a house, new car, etc). Unfortunately, in most cases, and especially if they weren't sure when the expense would arise, I could only shrug my shoulders, note that, across the board, all investment options with the requisite safety were the same, and collectively lament the low interest rate environment for savers. Over the past year, that has changed in more ways than one.

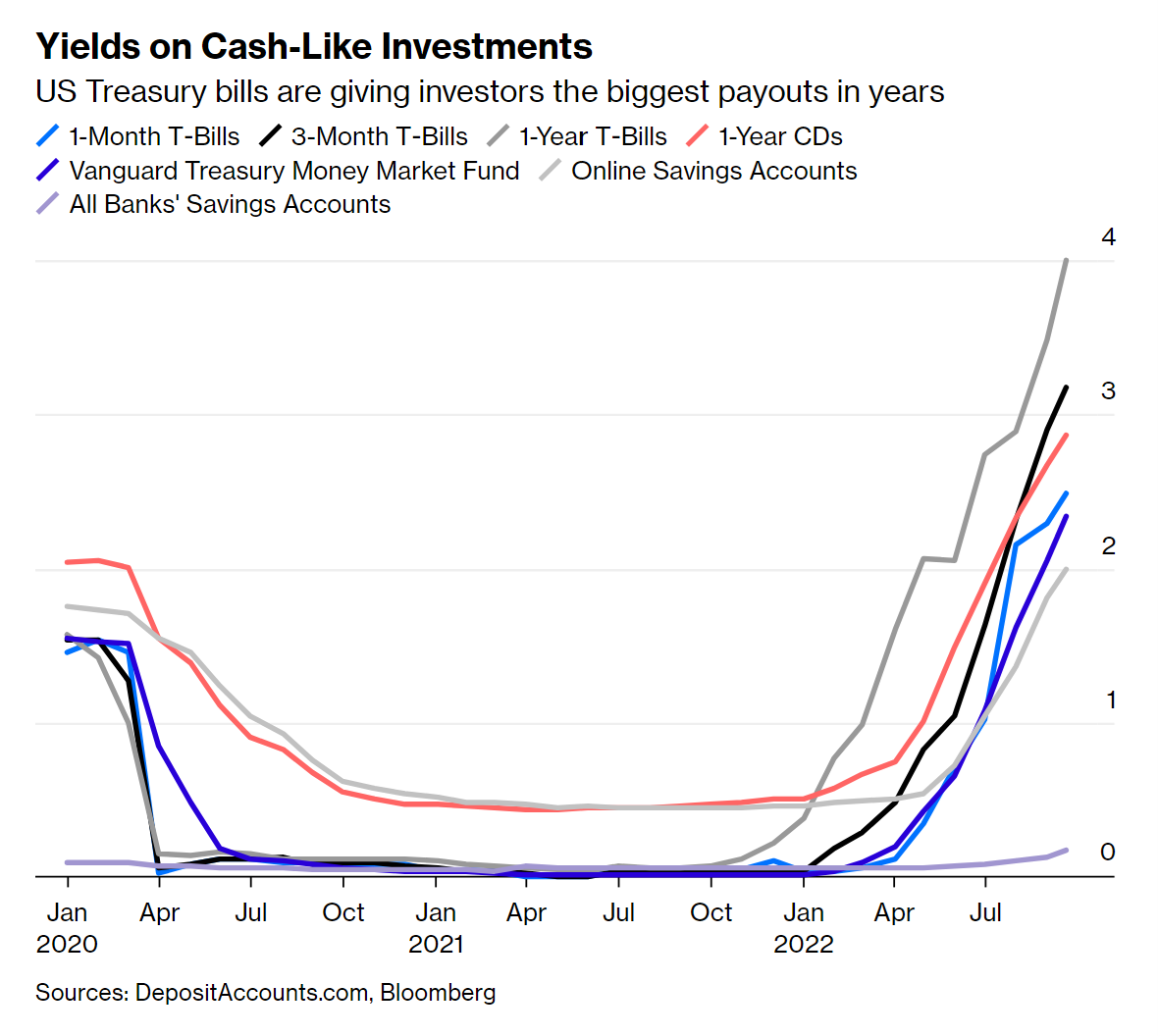

The obvious difference is that savers can receive significantly more because rates are much higher after 2022's Federal Reserve rate hikes and with expectations for several more rate hikes totaling at least 0.75% in early 2023.

The less obvious change is just how varied so-called "cash-like" investments are in their interest paid, with banks averaging well below .5% and some money-market mutual funds around 4%. For example, the 7-Day Yield on the Fidelity Money Market Fund (SPRXX) is 4.14% (as of 1/4/2023). If rates stay the same through the year, your cash will earn more than 3.5% additional interest than at the bank. Of note, I say “so-called cash-like investments” because readers should remember the lessons of the global financial crisis. In extreme cases, money market mutual funds can fluctuate in price and do not have the same FDIC-protection as the money in your bank account (See e.g. when the Reserve Primary Fund "broke the buck" in 2008) and even short-term Treasuries can fluctuate in price due to interest moves. That said, given the divergence shown in the chart between money market funds and bank deposits, we believe money market funds can be a great place for short-term cash needs.

So, why aren't banks raising rates along with the Federal Reserve? Simple - no one has forced them to. Consumers haven't moved their large cash hoards to other places, so banks are content to continue paying next to nothing while earning large profits by putting those same funds into higher earning areas of the market.

As the saying goes, there's a time for all seasons, and right now, given the stock and bond market volatility, it once again pays to pay attention to where your cash is working.

This material is provided for informational purposes only and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change at any time without notice. The information and opinions contained in this material are derived from proprietary and nonproprietary sources we deemed to be reliable and are not necessarily all-inclusive. All investing involves risk, including the possible loss of principal.